Who is emerging as “the world’s factory” in the next decade? India’s trillion-dollar giantic elephant eyeing “Make for World”

India’s manufacturing sector is currently undergoing significant structural transformations, positioning itself for a substantial surge in global exports. Despite being the sixth-largest economy globally and contributing 3.1% to the global GDP, India’s share in global trade remains modest at just 1.6%. However, strategic government initiatives such as production-linked incentives (PLIs) coupled with a surge in investments are poised to propel India into a manufacturing export powerhouse. This transition is supported by the adoption of cutting-edge technology and a skilled workforce, bolstering India’s competitive advantage in cost efficiency.

Several factors are driving the positive trajectory of India’s manufacturing sector, including expansions in production capacity, robust government policies, increased merger and acquisition (M&A) activities, and significant investments from private equity and venture capital firms. Presently, India stands as the sixth-largest manufacturing economy globally, attracting major global players to establish their manufacturing bases within its borders. Despite potential challenges such as recessionary pressures and inflation, the fundamentals of India’s manufacturing sector remain robust, with mega-trends expected to sustain growth over the coming decade.

Can India Sustain the Export Surge?

India’s manufacturing exports for FY21-22 reached an unprecedented $418 billion, marking a remarkable 40% growth compared to the previous year. This surge not only rebounds from the pandemic-hit FY20-21 but also surpasses the pre-pandemic peak of $328 billion in FY18-19. Unlike the pre-pandemic growth rates, which typically ranged from 5% to 10%, last year witnessed a sharp rise attributed to a significant increase in the share of manufacturing in the country’s total exports. The recent surge in Indian exports, particularly in the last few months, is driven by sector-specific gains, with the top 15 export categories accounting for over 72% of total exports. This surge is a result of global supply chain resilience focus and specific policy initiatives aimed at promoting exports. The manufacturing sector, benefiting from a skilled workforce and lower labor costs, is experiencing increased capital expenditure and heightened M&A activity, leading to a notable uptick in manufacturing output and its contribution to exports.

What are the Six Megatrends that Shaping India’s Manufacturing Sector?

India’s growth in manufacturing exports is influenced by six transformative megatrends that have been fast-tracked in the past two years. These megatrends encompass factors such as technological advancements, policy support, and global supply chain dynamics, driving India’s manufacturing sector towards unprecedented growth.

- Supply chain diversification: India has emerged as a top choice amid global supply chain diversification efforts.

- Government initiatives: Emphasis on investment, a substantial PLI outlay of $47.8 billion, and improved FDI policies.

- PE/VC-led investments: Record PE/VC investments of $70 billion in 2021, up by 55% since 2019.

- Mergers and acquisitions: In 2021, 90 strategic deals totaling $100 billion drove growth.

- Capex-led growth: High-capacity utilizations and a sixfold increase in projected capex.

- Sectoral advantages: India excels in Industrial machinery, Electronics, Pharma, Chemicals, Automobile, and Textiles.

Image credit: bain.com

Which are the Six Sectors Leading the Wave of Growth?

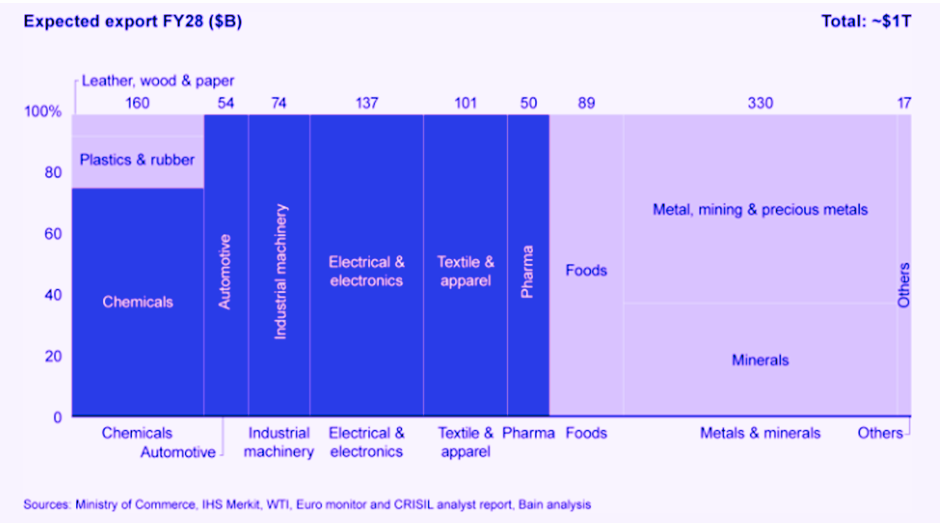

Bain analysis identifies six key sectors that are at the forefront of India’s manufacturing export growth. These sectors, including automotive, engineering, chemicals, pharmaceuticals, consumer durables, and priority sectors, are witnessing a positive impact from the identified megatrends. As India continues to capitalize on its competitive advantages, it is poised to achieve the ambitious goal of $1 trillion in manufacturing exports by FY28.

- Industrial Machinery: Expected to reach $110-$130 billion with a CAGR of 18-20%.

- Electrical & Electronics: Expected to reach $120-$145 billion with a CAGR of 35-40%.

- Chemicals: Expected to reach $110-$130 billion with a CAGR of 19-23%.

- Pharma: Expected to reach $45-$50 billion with a CAGR of 16-18%.

- Automotive: Expected to reach $45-$55 billion with a CAGR of 15-18%.

- Textile & Apparel: Expected to reach $95-$110 billion with a CAGR of 13-16%.

India’s manufacturing sector is on course to achieve a $1 trillion export milestone by FY28, driven by strategic policies and evolving global supply chain dynamics. The nation’s focus on meticulous planning, optimal capital allocation, and fostering vital collaborations positions it as a potential global manufacturing leader. Isler India, a key player in this transformation, offers comprehensive manufacturing solutions across diverse sectors including railways, aerospace and defense, industrial machinery, and electrical & electronics – all burgeoning segments in India’s manufacturing export landscape. The company is committed to contributing to this growth trajectory by leveraging AI/ML-powered tools to ensure efficiency and transparency across the entire design-to-delivery continuum.

Author:

Chirag Kakkar, Co-Founder & COO of Isler India, is a visionary leader dedicated to driving innovation and operational excellence. Leading a dynamic team, he focuses on empowering businesses and elevating the manufacturing industry through cutting-edge technologies and pioneering approaches. Committed to making a significant impact, Chirag is at the forefront of shaping the future of industry with strategic leadership and a passion for excellence.

Post a comment